How to protect your portfolio from 'greenwashing’

Australian investors who want their money managed ethically need to be alert for misleading and overzealous environmental and social claims.

By Hannah Wooton, Reporter, Australian Financial Review

Regulators around the world are on the hunt for “greenwashing” by investment firms.

Simon Letch

If you're talking to an Australian investor, there's a good chance they want their money invested in a sustainable or ethical way.

In fact, four out of five Australians expect their bank and superannuation accounts to have a positive effect on the world, and 84 per cent expect those providers to commit to reducing greenhouse gas emissions.

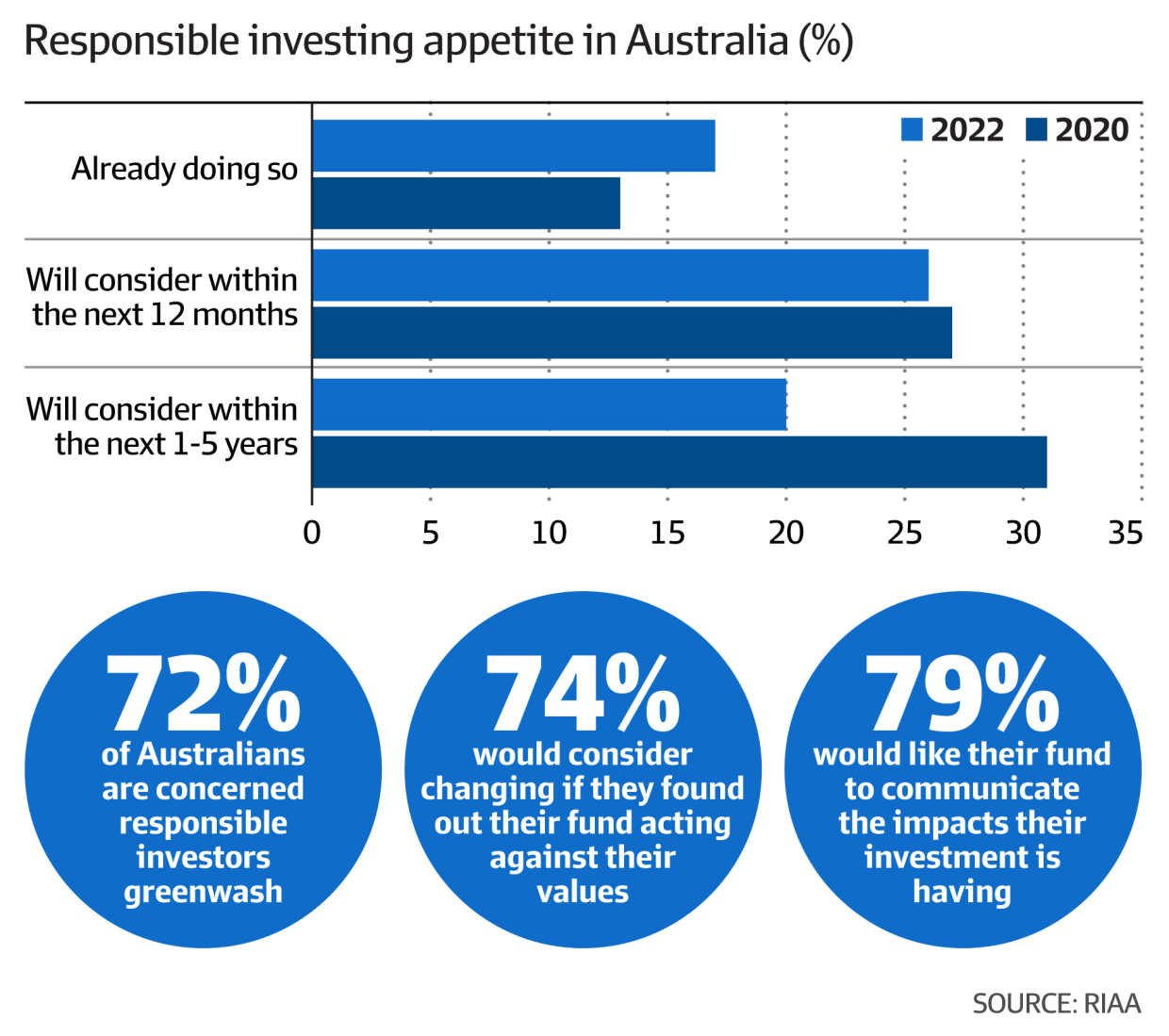

The number of consumers who care about these issues is rapidly increasing, according to a survey of 1097 investors by the Responsible Investment Association Australasia (RIAA). And a flurry of superannuation, exchange traded and managed funds tagged with the environmental, social and governance (ESG) label are hitting the market as a result.

But, at the same time, regulators and experts globally are warning of a rise in “greenwashing” – companies making environmental pledges to pull in customers, then not meeting these commitments in reality.

More than 70 per cent of respondents to the RIAA survey were concerned that “responsible” funds engage in greenwashing, and last month the corporate regulator launched its first court case alleging greenwashing by a fund with a landmark action against Mercer Super.

It’s an international problem. Index provider MSCI last week made changes to its methodology resulting in hundreds of ESG funds in Europe being stripped of their ESG rating.

So, how can investors avoid falling victim to greenwashing?

Investors need to know their own ethics, Danielle Press says.

Eamon Gallagher

Simon O’Connor says vague phrasing is a red flag.

Renee Nowytarger

Weasel words

Investment experts say the first step is to carefully consider the wording of the green claims funds are making and check this aligns both with your own environmental concerns and your understanding of those words.

“Look at how a fund describes the investment product – what words or labels are used?” Australian Securities and Investments Commission commissioner Danielle Press advises.

“For example, sustainable, ethical, green, responsible – are these words defined and does their meaning match your understanding?”

Here, some red flags indicating greenwashing can crop up, RIAA CEO Simon O’Connor warns.

“Vague statements, without appropriate description, is a sign that the product may not deliver to meet investor expectations,” he says.

“Investors should also be wary of products that use misleading or confusing terminology or make sustainability claims that are too good to be true and not backed up by the evidence.

“Investors should also be wary of products that use misleading or confusing terminology or make sustainability claims that are too good to be true and not backed up by the evidence.

“Broad sweeping claims about avoiding certain sectors, such as fossil fuels, can [also] be problematic, and should be defined much more precisely by sector – gas, oil, thermal coal, metallurgical coal, etc.”

Morningstar ESG analyst Erica Hall adds that strong net-zero commitments are an example of what detail green funds should offer.

“Higher-quality [ethical] funds are those that are following the Paris Agreement and at least minimum 1.5 to 2 degrees, and a time commitment of at least 2050,” she says.

Walk the talk

The more difficult question for consumers is whether the funds or investment products they are looking at then meet those commitments.

According to O’Connor, funds that cannot articulate how they are investing in sustainable businesses and assets, then quantify specific improved environmental performances from those holdings, may be engaging in greenwashing.

But managing this step can be hard for everyday investors – as ASIC’s allegations against Mercer suggest, the material that is publicly available about funds’ investment strategies may not align with their holdings in reality.

Australian disclosure requirements for funds are more lax than most comparable jurisdictions – “it’s crazy in such a sophisticated market that they don’t have to disclose beyond that,” Hall says – but she says there is still some information investors can look for.

She says to start with product disclosure statements, which all funds are legally required to publish.

“But you can’t look at it at a face value, so you need to read it properly,” the Morningstar analyst warns.

“If you can, look at underlying portfolio holdings as part of that. Not every fund will disclose that, but many will at least show their top 10.”

Green super

Super funds are also subject to tougher disclosure rules, making it easier for members to check whether they are walking the talk on their green commitments.

“It’s still reasonably limited – it’s mainly equity focused, and beyond that it’s just at an asset class level [or fund name for externally managed assets], but at least there’s granularity for listed equities,” Hall says.

VivaEthical Financial Advice director Elizabeth Hatton adds that looking at who is in charge of funds can offer some clues to how committed funds are to their green claims and if they have the experience to meet them, for example.

“You need to, as far as possible, look at the track record of the fund managers – if that information is publicly available – and the sort of funds and companies they’ve been part of before.”

“If they say they exclude certain industries or sectors, you can ask the fund for a list of companies they invest in or more information about what’s excluded.”

Screening green

If funds are taking the exclusion approach, investors should be wary of how and if they employ their green screens, Betashares’ responsible investments director Greg Liddell says.

This is particularly important for those in the booming ETF sector. (There is currently $9.95 billion in funds under management in the ethical, responsible and sustainability ETF category domestically, up from $7.1 billion last January.)

While many funds claim to screen out certain investments, they often just mirror indices without active or obvious ethical or social overlays.

Regulators are now pressuring index providers to tighten up their criteria for what qualifies as an ESG-compliant fund over greenwashing concerns.

They could have been involved in other funds accused of greenwashing, for example, or companies with poor environmental track records with no explanation for their change of heart.

Press says to use these documents to check funds’ investment strategies to understand how they invest in line with their environmental commitments. They may exclude buying shares in coal companies, for example, or could go further and proactively invest in renewable energy projects.

On both fronts, Press says consumers should ask funds for any information they feel is missing.

Greenhushing could ultimately help consumers, Erica Hall says.

Eamon Gallagher

But Liddell says consumers themselves can also scrutinise funds.

“Ethically conscious investors should be cautious about synthetic or derivative-based funds that claim to have sustainable or ethical goals ... Many funds say ESG on the tin, but actually mirror leading broad market indices.”

He recommends that investors looking for ethical ETFs that are actually sustainable should look for ones that apply “rigorous positive and negative screens”.

External ratings

For investors wanting to outsource their due diligence, looking at independent “green” rating systems can help, the advisers agree.

The independence of these raters is key, so investors should check whether funds need to pay to be evaluated, for example, which can be a red flag.

But Liddell says the RIAA’s responsible investment certifications are a good starting point. In this program, the association checks funds’ standards of practice and disclosure across banking, superannuation, KiwiSaver and investment products.

“Many funds say ESG on the tin, but actually mirror leading broad market indices.”

— Greg Liddell, Betashares

The Ethical Advisers’ Co-op also offers “leaf ratings”, whereby the extent to which investment products would suit an average ethical investor is evaluated by qualified financial advisers and rated out of five.

Hatton recommends consulting these ratings, as advisers look at not just what funds say they are doing, but also whether they then substantiate the environmental benefit of that.

Ethical and financial costs

The most obvious cost of greenwashing on its victims is ethical, but there are also financial consequences.

For a start, funds may charge higher fees for ethical screening when – as Liddell warns – they are actually just hugging indices.

“Check management and fees,” Press says. “Some funds will charge you higher fees for an ESG investment. And check how the fund manages the investment – [is it] actively or passively managed?”

Consumers who become aware of greenwashing may also pull their money out of the offending fund, which could drive up the cost for other investors or even force funds to sell assets.

“You’re getting out and getting a higher price for that asset but is that then being borne by all the other members?” Hall asks.

Hatton adds: “If it means [funds] have stranded assets, then longer term that’s not going to be a good financial outcome.”

Then, there’s the reputation risk that goes with such allegations. This means that even if a fund’s investors are not in its ethical options, their other holdings could still be devalued because of a broader loss of trust in a company or related party.

Enter ‘greenhushing’

With regulatory scrutiny of greenwashing ramping up, some funds are also starting to engage in “greenhushing”.

The practice involves companies stepping back their environmental commitments as regulators ramp up scrutiny of whether they’re keeping these promises. Several super funds deleted climate change commitments from their websites after the Mercer case was filed, for example.

In that case, ASIC alleges Mercer misled members of its Sustainable Plus fund by pledging not to invest in fossil fuel-intensive, gambling or alcohol production companies despite holding shares in 49 such outfits.

In the short term, this means there is less information on funds’ green commitments available for investors, advisers and analysts, Hall says.

In the long term, however, she believes it will lead to less greenwashing.

“In the past, [funds’] marketing teams have got involved and got really enthusiastic about the green capabilities and perhaps overstepped.

“But now it’s being looked at much more closely and they’re making sure it stacks up from an evidence-based lens. Asset managers will be more cautious about their green claims because they need to be able to back them up and verify and substantiate them.”

Next steps

If you have any questions about your financial situation or moving your money to responsible and ethical investments, call us for a quick chat or drop us a line.

This blog post reproduces an article that appeared in the Australian Financial Review (AFR). The article was published on the AFR website on 31 March, 2023, and was written by Hannah Wooton, a reporter with the Australian Financial Review.

VivaEthical Director Elizabeth Hatton was asked to comment for this article.

The article may also be accessed on AFR’s site here

(for AFR subscribers only).

Please note that all links within this article refer to other AFR articles, and are only accessible to AFR subscribers.

Want to get ethical?

We’ll help assess your intended investment against your priorities. We’ll work through what ethical mean to you, and how the companies you’re interested in manage environmental, social and governance issues (ESG) in their business.

Get our Guide to Ethical Investment with everything you need to get started

Stay on top of your finances

Getting your finances in order is one thing. Staying on top of them is something else again. A change in government policy, new legislation or amended regulations can have a powerful impact on how your finances are structured.

Subscribe to our regular newsletter to stay up to date with all the latest developments and changes.

Uncertain what to do next? Got questions?

Get certainty, direction and answers. Contact us now to talk through any issues you’ve got.

Together, we’ll get your money doing what you care about.